Latter-day Saints have long been encouraged to prepare for tough times by having food storage and basic supplies as well as some savings. Once again, I wish to recommend that your savings include cash that you can live of when things go bad. Part of the problem is that the available currency for US dollars is less than 10% of the total amount of dollars that have been created through America’s great credit bubble, meaning that when people feel nervous, the ATM machines will quickly be emptied and the banks won’t be able to give you your money. That may just be a short-term problem that can be remedied eventually with the help of emergency printing of bills by authorized or unauthorized counterfeiters with the help of the paper and printing industries. But there is an even bigger and more serious long-term problem: the banks you trust with your money can’t be trusted, as Wells Fargo has just illustrated (more on that below). And even if they are trying to be trustworthy, the US government can’t be trusted, and it may suddenly feel justified in freezing, blocking, or just snatching your funds. Money in the bank may not really be there in the end. So having significant cash on hand or somewhere relatively safe is one way of preparing for the bubbles that are bound to pop.

Wells Fargo should be a hot topic all over social media right now. What was exposed is a massive criminal conspiracy that should be sending dozens of executives to jail and raises huge questions about the rule of law in a nation that increasingly seems to be acting like a Gaddiantonized banana republic ready to to collapse. Jail and justice for massive theft and fraud seems to be an issue that is just off the table. The penalty for such widespread fraud and theft is just a fine that is a pittance for the corporate giant. Kudos to Bernie Sanders for asking the only meaningful question that everyone should be asking: who’s going to jail? (See his letter at the end of this post.)

Here’s one perspective as reported by Mark St. Cyr in “Wells Fargo: Who Says Crime Doesn’t Pay?” at ZeroHedge.com:

Unless you’re one of the few people still watching CNN, you may have missed what can only be one of the most scandalous in-house criminal activities to be uncovered at a bank.

And not just any bank. It happened at none other than Wells Fargo,

which, up until the scandal was revealed, was the number one bank (as

measured via its market cap) in the U.S. The scandal? Here are just a few highlights as reported. To wit:“On

Thursday, federal regulators said Wells Fargo (WFC) employees secretly

created millions of unauthorized bank and credit card accounts — without

their customers knowing it — since 2011.The phony accounts earned the bank unwarranted fees and allowed Wells

Fargo employees to boost their sales figures and make more money.“Wells Fargo employees secretly opened unauthorized accounts to hit

sales targets and receive bonuses,” Richard Cordray, director of the

Consumer Financial Protection Bureau, said in a statement.”And to use CNN’s own words to describe it: “The scope of the scandal is shocking.”

How shocking you may ask? Fair enough, here’s a little more from their reporting…

“The

way it worked was that employees moved funds from customers’ existing

accounts into newly-created ones without their knowledge or consent,

regulators say. The CFPB described this practice as “widespread.”

Customers were being charged for insufficient funds or overdraft fees —

because there wasn’t enough money in their original accounts.Additionally, Wells Fargo employees also submitted applications for

565,443 credit card accounts without their customers’ knowledge or

consent. Roughly 14,000 of those accounts incurred over $400,000 in

fees, including annual fees, interest charges and overdraft-protection

fees.”As scandalous as all the

above is, what is far more insidious, is the damage it inflicts (once

again) upon the very fabric of free market capitalism, trust in laws,

and last but not least: trust and belief in actual contrition. i.e., “No we’ve really changed, really!”

Cyr goes on to quote the official response of an executive at Wells Fargo who explains that the CEO who was in charge when all this fraud took place, a woman who has suddenly resigned and is walking away with more cash in a giant parting bonus than you and I could ever haul in the biggest wheelbarrow you’ve ever seen, was a great gal and helped the stock go up, up, up. Hurrah! So Wells Fargo has changed, wiped the slate clean, and will be much more careful in the future — careful not to get caught, I’m sure.

When major violations of US law can take place that are simply ignored by the enforcers, apparently because a company or VIP is to “too big to fail, too important to jail,” we are no longer living under the rule of law. It’s a symptom of a Gaddiantonized society and a sign of very big trouble to come. Those little slips like this one that get public scrutiny are usually the tip of a very sinister iceberg.

Whatever you think you have in the bank, remember that all those nice little intangible electronic digits consisting of 1s and 0s, can easily become a nice long string of 0s with the flipping of a few bits. Easier still, the bank can simply be put on a “banking holiday” as one of the great thieves of the past already did during a time of economic crisis in the US (the same thief who forced Americans to turn their gold over to the US government for $20 an ounce when the price would be $35 an ounce for the rest of the world). Be prepared for ugly surprises far more serious than paying a lot of spurious fees to Wells Fargo. You can’t trust your bank, or the people who control and regulate your bank, and the people whose primary loyalty is to the bankers of Wall Street, not the US Constitution.

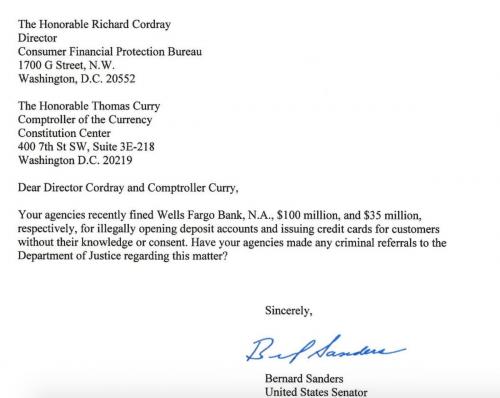

Though I’m not a fan of Bernie Sanders, I’m happy to praise him for asking the very important but actually taboo question in the letter below (courtesy of ZeroHedge.com):

Wells Fargo collected thousands in fees from me in the past before I finally woke up and moved my money to a local credit union (several years ago). They have been robbing their customers blind for years–it's just now that they've done something blatant enough and illegal enough to be caught.

As for cash reserves, the picture you paint above seems to show that it would be unwise to invest your value in cash. If the American dollar and banking system becomes as undermined as you describe, I'm not so sure a piece of paper will still hold much value.

Paper money will be the default and will have value, some value for years to come, and will be infinitely more valuable that digits alone once the ATMs run dry. Food storage is vital. I think some silver and gold coins are wise as well, along with other things having tangible value.

Just like the dollar was always backed by gold? Paper money is on its way out. I don't know why a physical representation of value is more secure than an electronic one?

I lived in Brazil in the mid 90s in the aftermath of their change of currency to the Real. Bank accounts were frozen and paper money became worthless overnight. Having a stockpile of cash in that instance would not have done much good.

I'm interested to know your thoughts regarding dollar amount or percentage of net worth. If I have $100,000 in the bank, should I have $1000 in cash? $10,000? What do you think?

After being ripped off by Bank of America waaaay back in my youth, I swore off banks for my financial affairs. For the last 30+ years I've kept my families money in credit unions. In fact, my current credit union here in Las Vegas has as its motto "The bank that YOU own". I've had very few problems with them and the couple of times I did, one call into their local customer service fixed the problem pronto. We get a nice dividend every year, the amount varies, but its happened every year for the last

20 years we've been a member. Frankly I'm not the least bit surprised about the Wells Fargo revelation…

How much you have in the bank is not the way to determine how much cash you should have. Look at what it takes to live for a month if you had no credit card or ATM card. Double that. Have at least that much, if you can. That's my suggestion. More might be better, but too much cash also becomes a risk due to theft, etc. Spread your risk around, diversify, and don't trust your bank or your account to be accessible or even to be there at all when you really, really need it.

That makes sense. Thanks!