Some readers here were shocked when I suggested that US banks are not a safe place to park your life’s savings. Let me ask for a moment: why do you feel safe? Have you done any research on the safety of your bank? Have you looked at their balance sheet, for example, or related financial reports, to see how much capital they have compared to liabilities? Most US banks are in precarious positions compared to many strong overseas banks, operating at much higher risk than they should be. If a few more of their loans go sour, or if a few more customers decide to take their cash out, many US banks could be in big trouble. Banks can fail. Customers can suddenly find their accounts restricted, frozen, closed, or “taxed” to pay for someone else’s mistakes. Why be complacent about this?

A while ago I called our US bank in Wisconsin and asked for their financial statement. Many banks publish this somewhere on their website, but I couldn’t find a link on my bank’s website so I called to inquire. The customer service people didn’t know anything about that and couldn’t find it either. They asked around. This was a question they didn’t get very often. Perhaps never! So they finally transferred me to their VP over finance. He told me that he had never been asked for this before by a customer, but would email it to me. Their situation was better than most, I’m happy to say, and we still have funds there, but I learned something valuable in this experience: nearly all of this bank’s customers have failed to even ask about the financial stability of the bank. If any of you have made a serious inquiry into your bank’s stability, please let me know what you did and what you found.

America’s banks have changed little since the tremendous problems a decade ago. The derivatives and junk that nearly brought our banking system down has not been cleared out of the system. The problems may be even bigger now. Yet in 2006 and 2007, before the collapse really began, our nation’s top banking experts were telling us that everything was fine. No problem. They are highly motivated to be blind. Your job, as the person responsible for your future, is not to be blind, nor to trust the silly statements of blind guides. Your job is to protect your wealth and your future and not rely on possibly bailouts from sources that may perish before you get your share.

Right now we are in a giant economic bubble driven by artificially low interest rates, massive consumer debt, massive corporate debt, and insane government debt. This will not end well. It never has. Food storage is essential. You also need some cash on hand for times when ATMs and credit fail. Having some assets outside of a bank and outside of the US would also be wise, for in the US it takes one crazed official to, say, accuse you of being a drug dealer or terrorist or Russian sympathizer or something to see your accounts frozen. It happens far too easily. There is risk that needs to be managed. Hopefully all will be well and 20 trillion dollars of debt will just go ahead from a generous gift from Putin or somebody and the stock market will just keep going up no matter how bad earnings are. But in case reality kicks in some day, it would be wise to make some preparations.

As for the market bubble we are in now, here is an excerpt from the SovereignMan.com newsletter I receive:

May 16, 2017

Reno, Nevada, USAThere’s something completely ridiculous happening around the world right now.

We can start in the United Kingdom, where the FTSE-100 stock market index hit an all-time high yesterday of 7454.

Simultaneously the British government released statistics yesterday showing that debt judgments and bankruptcy filings across the UK soared 35% in the first quarter of 2017 to the highest level in a decade.

British consumers are on a debt binge, borrowing (and now defaulting) at record levels.

This all sounds pretty sustainable.

Across the pond in the Land of the Free, the US stock market also hit a record high yesterday.

Simultaneously, consumer credit (i.e. DEBT) in the US is also at an all-time high of $3.8 trillion.

Even more specifically, margin debt, which is the amount of money that investors borrow to buy stocks, is at an all-time high.

Think about that: investors are borrowing record amounts of money to buy stocks at all-time highs.

This sounds like a fantastic trend!

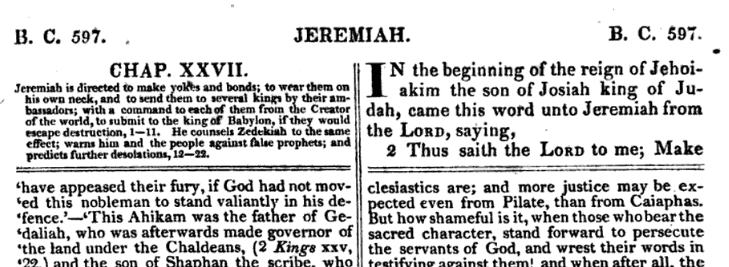

If you look deeper, the numbers become even more bizarre; let’s go back in time a few years and I’ll show you.

In 2012, Coca Cola reported $48 billion in revenue for the year, and $9 billion in profit. That was as pretty good year for Coca Cola shareholders.

For 2016, however, Coca Cola reported revenue of $41.8 billion, and $6.5 billion in profit.

So when you compare 2016 to 2012, revenue declined 13%, and profit declined 28%.

Given those dismal figures you’d think that Coke’s stock price would be a LOT lower today than it was back then.

But no.

After Coca Cola reported its 2012 earnings on February 12, 2013, its stock price was around $37.50.

When Coca Cola reported its 2016 earnings earlier this year, its stock price was $41.25. And today it’s even higher at $43.50.

Even more curious is that Coke’s 2012 report shows long-term debt of $14.7 billion. By 2016, long-term debt had more than doubled to $29.6 billion.

So Coca Cola is basically telling the world that its business is declining and they’re going deeper into debt. Yet investors continue to push the stock higher.

Makes perfect sense, right?

Now let’s look at ExxonMobil, whose 2010 annual report showed $383 billion in revenue, $30 billion in profit, and $12 billion in debt.

The company’s most recent annual report from 2016 posted $226 billion in revenue (42% decline), $7.7 billion in profit (74% decline), and $28 billion in debt (133% increase)!

Once again a rational person would think that the price of ExxonMobil’s stock (XOM) would be dramatically lower.

Wrong again. XOM is up from $78 to $83 over that period.

Then there’s Netflix, which has been one of the top-performing stocks over the last several years.

Bear in mind that Netflix actually LOSES money; it’s operating business lost nearly $1.5 billion in 2016, and the company continues to pile on more and more debt.

Earlier this month Netflix closed another $1.4 billion in debt financing, which is the third time in two years that the company has raised more than a billion in debt.

Netflix’s total long-term debt and content liabilities (the amount of money they’re legally required to pay to content owners) is approaching $20 billion, and rising.

Lose money, go into debt. Not exactly a recipe for success.

Yet curiously the stock price is at an all-time high.

Companies are losing money, declining in business value, and having all-time highs in their stock valuation. The bubble of cheap credit in the US is being used by companies to buy back stock and pay dividends, massively increasing corporate debt to drive up the stock price. This does not end well. Are you ready? It could be years before reality kicks in, or it could be next week. Please consider preparing, wisely and steadily, for trouble ahead

I'm a strong believer in living debt-free (or at least getting there as soon as possible), diversifying one's assets, etc. I'm no friend of the big banks, either (for personal banking, it's local credit unions for me, thank you very much).

Though I'm not a financial wiz by any stretch of the imagination, I did manage to retire at age 58. Save your pennies, avoid debt as much as possible and pay it off early, put extra money into your retirement account, buy an extra residential property when you can and lease it out (let the tenants pay off the mortgage), etc. It's not rocket science. It's 10 percent knowledge and strategy, and 90 percent self-discipline.

That said, I think Simon Black (aka SovereignMan) is a humbug. His political philosophy is amateurish and poorly informed (I'd be happy to elaborate), and his economic analysis is a mix of the obvious and the ludicrous, obviously designed to induce anxiety in his marks. (Sales 101: first convince the mark there's a problem, then offer to sell him the solution, which you just happen to have in your briefcase….) His writings are designed not to inform the public but to sell a product.

And yes, Black is definitely selling something: For his SovereignMan Explorer package he charges $195. SovereignMan Confidential membership is $995 annually. Fourth Pillar membership is $1,795 per year.

This is Trump University stuff. Not fraud, exactly—just charging ten times more than the product is worth. One would be better off taking a financial literacy, economics, and/or intro to business class at a local community college (or even just reading one of the financial literacy, economics, or intro to business textbooks available for free online).

At the local community college you can get the necessary knowledge, but of course you won't get that little frisson of being part of Simon Black's radical cognoscenti. That sense of being an "in the know" insider is what Black is really selling.

— OK

Oh good, another fun banking post from Jeff. As good a financial strategist as he is an apologist!

If you thought it was bad in the US, just think of China’s unsustainable and exponentially larger bubble.

People do not ask about their bank’s financials, because unlike Mormanity, most account holders have less than the FDIC insurance amount in their accounts. Bernanke was interviewed recently on Planet Money. He indicated that security in FDIC insurance is why economist missed the 2008 financial crisis. The 2008 numbers were worse than the 1929 numbers, but nonetheless pricing structures were successfully stabilized.

The late artist formally known as Prince was a Jehovah Witness. One million dollars in gold bars were found on his estate. Culturally Mormon’s encourage fiscal responsibility, but usually stop short of the Jehovah Witness financial Armageddon Mormanity promotes.

Not that Mormanity does not bring up some strong points. PE ratios do seem high, but how do we know unprecedented global wealth does not provide increase investment cash and therefore new averages for lower interest rates and higher PE ratios?

Anon, if you're complaining about my advice for fiscal responsibility and concern about the security of our financial systems, I'd appreciate a reasoned rebuttal. Given the levels of debt, spending, and bank capitalization, there's an easy case to make that our current situation is more precarious than it was in 2007 or on the eve of the dot-com collapse or even 1929. If you think all is well, please explain why.

Mormography, in 2006 and 2007, for those few voices — none among the the Federal Reserve or other government experts — who wisely warned that our banking system was at serious risk before the financial crisis caught all the experts by surprise, did you feel that their concerns could be dismissed as extreme "financial Armageddon"? If you are aware of what concerns they were correctly pointing to then, is there evidence that any of those problems have been alleviated since then? I think there's a case that all the trouble that was brewing now has only been made much worse and more unstable, propped up with QE and an explosion in new credit, clearly unsustainable. This bubble cannot end well.

I do not necessarily disagree. Yes, I was too nonchalantly dismissive before 2008. Nonetheless, now that we are a decade away, my dismissiveness is vindicated. Yes, the long-term debt cycle is at the peak. But wealth is assets minus liabilities. Total equity in the US recovered nicely, with several tens of trillions of assets greater than debt. Much of this was due to the central bank’s ability to maintained price stability, successful kicking the can down the road out of the way of an impending train wreck. Though the numbers were worse than 1929, the solution was easier than the stagflation of the 1970s.

Economist continue to debate the cause of the Great Depression, with no definitive study determining an exact cause. However, there is a curious correlation between the gold standard and recovery from the Great Depression. Spain was not on the gold standard before 1929 and did not experience the dramatic economic swings of other countries. Japan abandon the gold standard early into the Great Depression and recovered sooner than other countries. The theory is that the gold standard prevented central banks from increasing the money supply. If anything, 2008 proved this theory correct. Absent the gold standard, central banks increased the money supply greatly successfully propping up pricing structures.

Before 2008 most people told me that deflation is hard problem, pointing to Japan. I rebuffed this idea, saying deflation is easy, just print money. I feel vindicated.

The root cause of 2008 was not the repeal of Glass Steagall or securitization, but the two credit rating agencies, one of which was owned and is still owned by Warren Buffett. Both credit rating agencies successfully and quickly overcame US Government lawsuits. To this day, I am shocked the European’s have not considered the fraud perpetuated by those two American credit rating agencies a near act of war.

Having witnessed these bubble cycles, I am much more sympathetic to main street. Bankers make large, questionable commissions allocating money we the people choose to print. Japan and America both briefly experimented with helicopter money and the results did not appear all that bad.

"Food storage is essential. You also need some cash on hand for times when ATMs and credit fail. Having some assets outside of a bank and outside of the US would also be wise."

This, and working to be debt-free, are all basically good counsel for someone in your position, for you live abroad and already utilize a bank there. But for Americans who don't travel abroad regularly, putting money outside the USA isn't such a great plan these days. Foreign banks are less willing to work with middle-income and/or non-shady Americans due to US banking disclosure law changes (FATCA). Also, how, in the face of natural or cyber calamity, would a non-traveling resident of the USA get their funds out of the foreign bank? Other ways of diversifying assets makes more sense for the homebodies here.

If you think all is well, please explain why.

Oh, come on, Jeff. Where did I say "all is well"? What I said was that Black's "writings are designed not to inform the public but to sell a product."

For example, he tells us that "consumer credit (i.e. DEBT) in the US is also at an all-time high of $3.8 trillion." Oddly enough, he doesn't mention that the U.S. population is also at an all-time high. He gives us a raw total rather than a per capita figure. He also doesn't mention that household debt service (debt payments as a percent of disposable income) is at an all-time low. This is mostly because population is up and interest rates are down—two obvious ways in which today is not equivalent to 2008, two obvious ways in which Black's "analysis" is ludicrous.

His rhetorical use of the phrase "all-time high" is frankly idiotic. With an expanding population and economy, new records are set all the time, as a matter of course. By themselves, as raw figures, they mean nothing at all, yet Black tosses them around as if they were clear signs of Economageddon.

Black gives us the frightening stuff, but not the mitigating stuff. He selects his facts with an eye toward scaring his marks into buying his vastly overpriced products. He's a con man, not someone trying to convey truth. Why in the world would you help him run his con by linking to his site?

One more thing—need I add that alerting people about a con is not the same as saying "all is well"?

— OK

OK – Obvious points you should not have to explain. The fascinating part about Mormanity recently is how anti-American he is becoming. The Chinese econ numbers could use a much more critical inspection, but he is silent.

I think Jeff was talking to the anonymous poster at 10:59, just after OK's comment. The one who did not give any sort of rebuttal, but just tossed insults around.

I'm the anon you called out, Jeff, but I think OK has already said it best. You're parroting the nonsense of a con artist, which, in retrospect, isn't too strange an occurrence on a blog dedicated to a Mormon apologetic's hobby dabbling.

OK, I wasn't responding to you but to the other anonymous poster who has previously taken me to task for daring to suggest that banks in the US aren't the epitome of safety and that there could be severe economic problems ahead. Your remarks were reasonable, though your critique of Simon Black was off, in my opinion.

But yes, many financial commentators and stock market pundits do make a living by selling the results of their analysis to subscribers in newsletters, not completely unlike experts in, say, American literature selling their services to university students who subscribe to their courses. The fact that someone uses their expertise to make a living does not necessarily make them a nut job, though the buyer and the student definitely needs to beware because there are a lot of nut jobs out there peddling ideologies devoid of substance. Simon Black's analysis, however, is rooted in data and practical experience. He actually owns and runs a bank and is intimately familiar with what's happening in the banking world, and it's not a comforting picture.

CT, you are right, it is very difficult for American's to create an overseas bank account or take other steps toward a Plan B outside of the US borders. One option to consider is SilverBullion.com, a well capitalized Singaporean operation where you can create an account, wire money in, and then use it to purchase precious metals. Other funds in your account can sit there or can be loaned to other customers for reasonable interest rates to allow them to purchase precious metals. The loans are 100% collateralized because the assets purchased are there in the vault in Singapore. This is not a bank, but a place to invest in precious metals and perhaps park some extra cash. It is outside the jurisdiction of the US, but you do need to report any funds put there to the US government each year if your total funds in banks and other financial institutions outside the US is $10,000 or more.

There are still a couple of places where Americans can go and open foreign banking accounts — the Republic of Georgia being one of them. Difficult, though. Another option that some may think about is obtaining a second passport. This can be easy for some countries if you are descended from parents or grandparents who were foreign nationals there. It can also be done by "investing" a large amount of money in some jurisdictions such as St. Kitts. One of the less expensive routes appears to be Panama, although as I recall it takes 3 years and requires some work and establishing some kind of presence there. But it's a terrific country and perhaps a smart option for a Plan B.

Mormography, I'm not anti-American. I love American and cherish the US constitution, unlike most of the ruling class from either of the two dominating, interlocked, and corrupt parties. I'm pro-American, pro-Constitution, pro-liberty, pro-freedom, pro-individual rights, pro-limited government, but anti-corruption, anti-swamp, anti-economic-implosion, anti-empire, and anti-dictatorship. Seeing the swamp and the military-industrial complex take over America and drain the financial resources of the land while stirring up global hostility and unnecessary bloodshed in many lands requires that I speak out while speaking is still possible. To mistake my distrust of corrupt leaders and their brazenly corrupt schemes with hostility for America is the very mistake that the Swamp wants you to make. To be against their schemes will be painted as being against America, but this has never been so. It's a terrible mistake to make.

Who did you vote for, Jeff?

Bubbles do happen but if they were so easy to recognize they wouldn't be the problems that they are.

You can always find something worrying even when times mostly look good, if you look hard enough for flies in the ointment. It's certainly easy to sound the alarm when times mostly look bad, if you deliberately don't look hard enough for silver linings. So it's easy to predict a coming recession every year. Business goes in cycles so eventually you'll be right.

You can then trumpet your prophetic success, and charge people more to read your newsletter. But what would have happened to the people who actually listened to you every year, though, and followed your advice to put all their money into Krugerrands under the mattress or whatever? They would have missed out on years of good investments, and probably not done much better even in the crunch year than ordinarily prudent investors.

Long term, they would have lost big. Crackpot financial advice is easy to give but generally not very good.

How dire are the economic signs right now? It's not surprising that everything is "highest ever". So is the world population. So are lots of things that grow over time. The world really is very much richer than it ever has been, even if you only count solid, physical improvements like better roads and more supermarkets. The economy keeps growing, on average. So there's a good chance for any year to be the biggest year ever—in profits, losses, investments, debts, everything.

Interest rates are really low right now, so now is a really smart time to borrow money and invest it in businesses, new houses, whatever. The fact that debt levels are high along with the stock markets might be a sign that we are all building a house of cards because stock prices are only high because credit is cheap. But it might also just be a sign that a lot of people are smart enough to launch new enterprises now, while interest rates are low for start-up loans. In which case we're probably in for a boom, not a crash.

I don't know, but neither does this SovereignMan guy. At least I'm not selling a newsletter.

Mormanity –

Funny. You claim to be pro-American in the same breath you accuse the bulk of Americans (two dominate parties) of being corrupt. Accusing your fellow Americans of being either complicit or incompetent in dealing with the brazenly corrupt, while making zero mention of other countries, is exactly the mistake China wants you to make. Yes, America and Americans are imperfect. Who isn’t? Ragging on only the beauty queen’s asymmetries just makes you look bad.

https://www.nytimes.com/2017/05/23/business/moodys-downgrades-china-economy-debt.html?_r=0

Mormography, I was talking about America. That doesn't require that I mention every other country with severe corruption problems. Yes, there are many. China publicly acknowledges problems in corruption that need to be stamped out. There's been amazing progress. But where there are problems, we foreigners living here are not the ones who need to or who should point fingers. We really must be respectful and patient and abide by the laws and regulations of this land. But as a US citizen able to compare the trajectory in the US with that of other nations past and present, the trend is alarming, and I am free to speak out on that. Sorry you interpret that as an unfair criticism of the United States. I'm not interested in the beauty contest you mention. I'm interested in the United States per se and its long-term success, liberty, and prosperity. Finding that, say, Venzuela or Iran has more corrupt politicians provides me no comfort.

Further, sir, to criticize a party as corrupt, or both parties as corrupt, does not demean all those who feel they must vote for the party that best represents their views. I can understand why Republicans and Democrats would continue to vote for party members, even when they might not be 100% comfortable with the party of their choice, or, like me, suspect that both parties are corrupt. We've been raised to think it's all about choosing the right party — I can't blame people for not recognizing they are part of the same act in the end. Part A or Part B — what else can people do? So they are raised.

Yes, life is full of compromises. I can understand smart people supporting either party, based on what they know and their cultural perspectives. My criticism of the politicians at the top is not a condemnation of those who love America and want to make it strong by working through the party of their choice.

Who did I vote for? A third party: Constitution Party. They had me as soon as I read their platform and saw that they didn't see a need for American to be involved in global war that doesn't safeguard our borders and comply with Constitutional principles.

OK, it's true that per capita debt is down slightly from its peak in 2008. Debt decreased during and after the crisis. This not necessarily because Americans were becoming more frugal and were finding more money to pay off loans. As explained in a good article on consumer debt in the Washington Post a few years ago, "It is reasonable to assume that the decline in mortgage debt in housing bubble states — in no small part attributable to foreclosures, short-sales and restructurings — is a major part of the total decline of Americans' debt levels."

If you prefer a discussion of debt from a more liberal analyst, consider Richard Vague's piece for the Atlantic Monthly (Sept. 2014), Government Debt Isn't the Problem—Private Debt Is. While I strongly disagree with his view that we need to force banks to forgive debt and don't need to worry about the massive Federal debt, he does make an important point about the binge of private debt that has continued over the past decade, in spite of a slight decline from the darkest days of 2008. The level of private debt is alarming and, as he argues in his book, has been a key factor associated with major economic crises in the past. He argues that we are on the verge of disaster in the near future. This aspect of his article is quite reasonable. The big government approach of forcing banks to forgive that debt as an easy fix to the problem leaves me shaking my head. But whether you agree with the fix or not, I hope you'll consider his point about private debt.

James, the low interest rates right now are artificially low, the result of a bizarre experiment in big government meddling that has never been done before in the history of the world: over a decade of near-zero interest rates. This has led to a massive misallocation of resources, motivating companies, cities, states, and individuals to go more heavily into debt, fueling fake bubbles in the stock market and other markets, and causing theft of interest income for those who saved. This artificial level, contrary to the real market price of money, cannot be sustained. It's a bubble that must pop. Wither the currency falters or rates rise or other massive shocks occur. A modest rise in interest rates would leave millions unable to service their loans as they roll over and rates go up. It's such a warped situation. Cheap credit has become like heroin going into the veins of the economy. The longer it continues, the unhealthier and more painful the final correction will be.

Another readable treatment and more optimistic of the debt situation in the US is the "2016 American Household Credit Card Debt Study" shared at Nerdwallet.com.

Mormanity, I was talking about your anti-American posts recently. That doesn’t require me to list every time you accuse America of false flag use of WMDs, of facilitating complex conspiracy theories, or of wrongfully using the A-bomb, etc. Your adjectives in this article are inherently comparative, so no you were not just talking about America. In fact, you were actively encouraging putting money in other countries. For example, if someone is going to accuse Israel of being a "human rights violator", then comparatively the phrase "human rights violator" is meaningless.

Fascinating. When you talk about Mormon leaders you demand charity, but America and American leaders do not deserve one nice thing said for every two critical items.

Mormanity – You should really take a moment to listen to yourself. Above, you say fascist China knows it has problems is dealing with them, but the Chinese people and foreigners are not allowed to talk about them. Then you say, America doesn’t know it how big its problems are, despite its people and foreigners being allowed to constantly rag on her. I used to think you were more mature than me.

I read another blog about a year ago complaining of the grief a bank gave him when he asked to withdraw $1 million in cash. Why do banks feel the need to lecture patrons about taking physical ownership of their property?

NaRong – Sniping or phishing? Why didn’t you title the links better?

Vague’s analysis is a little vague, but is good news for the US, being his chart shows since 2008 US private debt has base-lined while asset values increased.

His analysis misses the power of printing money. In 2034, the CBO projects SS will default. However, if the Fed gifts $2 trillion of the money it has already printed to SS, default will be prevented … especially if public debt decelerates, allowing the US Congress to finally pay interest on the debt instead of capitalizing it.

Thank you for sharing valuable information.

SCR888

ACE333

goldenslot

โกลเด้นสล็อต

golden slot

สล็อตออนไลน์

แทงบอล

แทงบอลออนไลน์

สมัคร goldenslot ได้ที่นี่

goldenslot

สมัคร goldenslot

โกลเด้นสล็อต